Can Someone Withdraw Money With My Account Number

As discussed in previous posts, in one case you're using PayPal to sell your stuff online, you volition also want to somewhen withdraw the money you make into your bank account so that you can really use information technology. Here'south where things get a fleck nasty, unfortunately.

If yous have a US banking company account and a US PayPal account, you can stop reading correct here. Y'all're in luck. All you have to do is attach your bank business relationship to your PayPal account and withdraw USD from your PayPal account to your bank business relationship. In that location are no currency conversions to worry about, and the transfer itself is free from PayPal's side.

If you are the possessor of a non-US PayPal account andyou don't have a U.s. bank account, things are not so pretty.

You are given two options (depending on your home land, it might even be just 1 pick):

- Withdraw to a debit or credit card

- Withdraw to your local bank business relationship.

By the way, did you know that you tin can now buy Bitcoin and cryptos with your PayPal account on Coinbase and eToro? Read my guide to buying crypto with PayPal to find out how.

If yous sell online you probably use USD equally the main currency on your store and hence your PayPal balance will be in USD. What happens is that since your local credit carte du jour or bank business relationship are not in USD, an automatic currency conversion takes place on PayPal'south end equally the money is on the mode out. The conversion rates are bad, to put information technology mildly. Hence you lot're going to lose a lot of money on that conversion.

Withdrawing your funds from PayPal to a debit or credit menu tin can be annoying if you have meaning funds. The reason is that you can merely withdraw up to $2,500 at one go, and every time yous make a withdrawal you are charged $two,50.

So let'south say you need to withdraw $fifty,000. You lot will need to become through the withdrawal process 20 times for a total price of $sixty. This sounds ridiculous; a time-wasting activity and also a money-take hold of past PayPal. It is, there's no other mode of looking at it.

The other way of withdrawing is to send the funds directly to your bank account. In that location are no limits when compared to withdrawing to a carte. Sounds like nosotros solved our problem right?

Well, not so fast.

If your bank account is in a different currency than the funds you take stored on PayPal, be prepared to lose a meaning amount of money due to PayPal's horrible exchange rates. PayPal does not allow you lot transport, say, USD directly to a EUR-denominated account. This is a limitation on their finish, and I suspect an intentional one to fleece their users. There are no such limitations when using other payment gateways such equally 2Checkout.

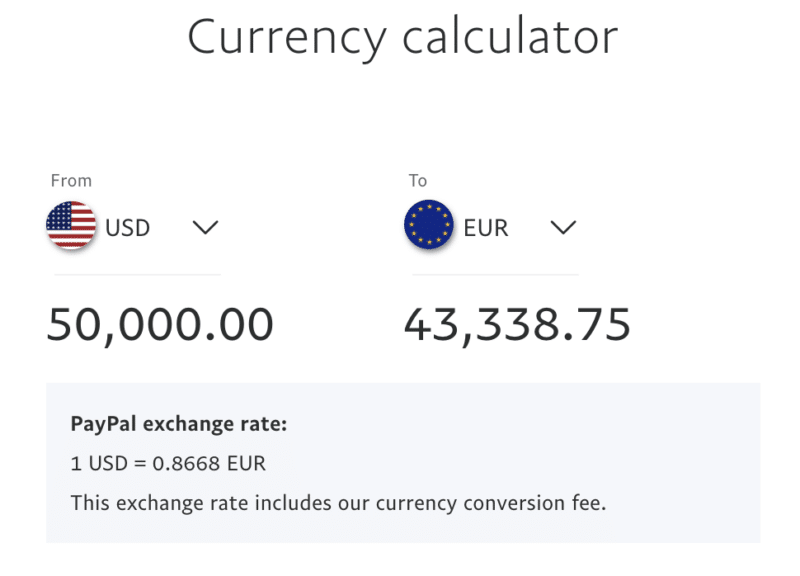

So let's get back to the $50,000 example. Let's see what PayPal is ready to offer usa in Euros:

And so for $50,000 PayPal volition offer us €43,338. On the other mitt, using the rate from a local bank, I become a significant difference: €43,775. And that'south just a local sometime-fashioned bank, not i of the dedicated currency conversion companies like Wise.

Wise would, in fact, give us €44,378, more than a €i,000 difference compared to PayPal, while Currencyfair would give us ¢44,332, which is also significantly better than PayPal.

I personally find it unacceptable to drop a thou euros like that. This is why I volition continue to withdraw using the lightheaded method of withdrawing $2,500 at a time, but because the total cost is still much lower. Using that method, as I showed you lot in another post, you can get PayPal to send USD straight to your credit card, whatever its currency.

Before we keep, information technology would exist a good move on your end to check whether other services like Wise or Payoneer would be an even better fit for you than PayPal. In general, I recommend trying to find an alternative to using PayPal for whatever you are trying to exercise, since PayPal has terrible customer back up and charges high fees.

Withdrawing to Cards

In the case of cards, you tin can ask PayPal to switch off automated currency conversion, and have the conversion happen on your depository financial institution's side, which will requite you a meliorate rate. I wrote about how to practice this in my before postal service on currency conversion and PayPal. There are still two inconveniences when withdrawing in this style:

- You will be forced to convert USD to your home currency upon withdrawal.

- There is a limit per transaction of $two,500, and an associated fee per transaction.

These ii points are problematic. Let's say that your home currency is in a weak position and you would therefore shop coin in USD and convert later when things improve. You cannot do this as you can't practice a straight through USD-USD transfer, given that your bill of fare will be denominated in the local currency. You tin can open a local depository financial institution account in USD but you lot won't be able to go a carte du jour associated with it. At least that's the case with all the banks I've checked and so far. If you detect a bank that lets you do that, please leave a annotate and let me know.

The limit per transaction poses some obvious problems. Let'south say you are a loftier-volume seller and you want to withdraw $100k per month from PayPal. You volition have to make 40 separate transactions and you will exist charged for every unmarried one of them. Of course, all yous always wanted to do is ane transaction, if only PayPal let y'all exercise that. Apparently, this limit per transaction is dictated past the carte du jour providers (for example MasterCard or Visa). All the same, information technology'southward non convenient for serious sellers.

If your depository financial institution does not provide good conversion rates, remember that some PayPal users take had success linking their PayPal account to digital banks such as Revolut, Wise and N26. They typically provide much better rates than your local bank. Y'all might want to give that a shot since opening an account with these digital banks is complimentary anyway.

Note that as from Apr 2022 the $2,500 limit seems to have been modified, as I have been able to brand significantly bigger transfers to the debit carte. I'm not sure if this is a glitch or whether something really changed from PayPal'southward end.

Buying Crypto with PayPal

Did you know you lot tin now buy crypto with PayPal? That's correct, you lot tin use Binance or eToro since they both accept PayPal deposits. Merely hit the links below to go started.

You can also read my full review of Binance to learn more about this crypto substitution.

Purchase Bitcoin with Binance

You can also read my full review of eToro to learn more about this platform.

Purchase Bitcoin with eToro

Highly volatile unregulated investment products. No European union investor protection.

This withdrawal method is extremely popular at the moment, as people worldwide seek to go themselves some Bitcoin or Ethereum due to their extremely bright future price prospects.

Withdrawing to a Local Banking company Account

Withdrawing to a local bank business relationship does not present any limits, and then y'all can pull out that $100k without whatever issues at i go, however, y'all will be striking by PayPal's bad exchange rate plus currency conversion charges. It is usually like shooting fish in a barrel to open up a USD account with your local bank, the big trouble is that PayPal will non let y'all to transfer USD from your PayPal balance into your local USD account if yous are based in Europe, as they consider all European banking concern accounts equally Euro-based.

Note that in April 2022 I was able to add a USD account to my PayPal business concern account, so there seems to be a way to get a non-Euro banking concern business relationship added. I had to ask PayPal to add it manually, as the link in the dashboard did non let me do information technology. I will exist testing a few withdrawals with this method and will update the section below if I encounter that it becomes more than advantageous to withdraw to the USD bank business relationship instead of the debit carte.

Real Case – Withdrawing to Menu vs Local Banking concern Business relationship

Equally an example at the time of writing this article, if you transferred $10k out of PayPal via a bank transfer to a local bank in Malta (the state where my bank is account is located in), yous would have ultimately received €8,839 in the banking concern account. My bank does non charge whatsoever fees for currency conversion.

On the other hand, if you were to withdraw that same $10k out of PayPal to a debit/credit bill of fare linked to the same account, you would get €8,911. That corporeality is later on deducting PayPal'south card withdrawal charge ($two.50/€2 per withdrawal, up to a max of $2,500 per withdrawal; hence four withdrawals would be needed in this case to get $10k out).

The local bank was using 0.8921 as the commutation rate between USD and EUR.

PayPal, on the other manus, was using 0.8839, a significantly different rate.

PayPal includes the charges within the exchange rate, so if you accuse them of having a actually bad substitution charge per unit their excuse volition be that it includes the currency conversion fees.

At the end of the twenty-four hour period and then, we would be better off when withdrawing to a carte du jour past €72.

Not that pocket-sized of an amount, particularly if y'all beginning considering transferring higher amounts. The difference would be around €700 on a $100k transfer, which is ridiculous.

Another problem is that PayPal does not send you any kind of bill for the currency conversion fee, hence y'all cannot expensive it in your company's books. It is totally hidden within the exchange charge per unit they employ so there's nothing you can do about it from an accounting point of view.

Other Options

The difficulties detailed above touch on every country in the world except for Canada. In Canada, users take found a loophole that allows them to perform USD to USD transfers without any charges. See hither and hither. In one case again I had this confirmed by a PayPal support agent, as tin can exist seen in the e-mail extract below:

While not being familiar with all of our 200+ countries' user agreements, I am fairly confident maxim that Canada is the merely country we have with an exception that allows a local USD denominated banking concern to be added and used.

I believe this is also related to how the US and Canadian depository financial institution network is cooperating. Regardless, this is non something we offering to a Maltese account, other than if y'all had an actual bank account registered in the U.s. to withdraw USD to.

There are some other options one could explore:

- Use BrainTree instead of PayPal

- Open a non-resident Canadian bank account with RBC

- Open a Canadian PayPal account connected with an HSBC banking concern account in Malta

- Use Payoneer

- Employ Etrade

- Open a US bank account

I've written near BrainTree already, so you can refer to my earlier mail service most the service, although I don't actually consider information technology a full culling to PayPal as buyers would need to utilize their credit menu instead of a PayPal account when paying.

Opening a Canadian banking company account with RBS is easier than opening a US bank account. I don't accept much experience in this area except checking if it'south possible and confirming that information technology is. What one would do then is use the routing number of that banking concern account to add it every bit a US bank account within PayPal and withdraw money into the RBS account. And so one would utilize Wise to transfer the funds to a Maltese bank account. I am yet checking to confirm 100% whether PayPal would let this setup on a Maltese banking company account or not.

The Canadian PayPal account plus Maltese HSBC USD account is an option that I'm still checking well-nigh, so I can't make any recommendations at this stage.

Until a few months agone it was possible to open a Payoneer account and then add that to PayPal equally a bank account via the routing number y'all are given. The idea was to so withdraw the coin into your Payoneer account as yous would accept done with a US bank account. From then you would then be able to transfer to your local bank account or else pay using the Payoneer Mastercard or even withdraw cash from an ATM. Information technology appears that this is no longer possible, although information technology's worth monitoring this option as things may change in the future or an culling to Payoneer might ingather upwardly.

Opening an Etrade business relationship and withdrawing coin to information technology is also another option that I've seen beingness discussed, and once again I need to look into it in more item.

The final selection would, of class, be to open a USD business relationship with a Us bank, something that is easier said than done. Usually, a Social Security Number (SSN) is required, however, some banks allow yous to open up an business relationship without it when visiting the branch in the Usa. There might still exist limitations though (for example, no bank transfers possible) which would limit the practicality of such an business relationship for my particular desired usage. Some people take also asked me whether it is possible to open a US bank account for their non-U.s.a. company. Equally far as I know this is impossible unless you are going to deposit a few 1000000 dollars into that account.

If you have found a solution I'd love to know how you managed, delight go ahead and exit a annotate!

Further reading

- PayPal Steals from Its Customers with Subconscious Fees – Peter Sandeen from Finland

Looking for Investment Opportunities?

Here'south a handy widget that will help y'all sift through a varied drove of platforms. Some of them are based in the U.S. but are also available to international investors.

Source: https://jeangalea.com/withdrawing-money-from-paypal-for-non-us-accounts/

0 Response to "Can Someone Withdraw Money With My Account Number"

Post a Comment